affordable wellness pet insurance that pays for what matters

Decision snapshot

You say yes if routine care will outpace the premium this year, and the plan reimburses at or near your clinic's prices. You hold off if the math is upside down or you already get discounted wellness bundles from your vet.

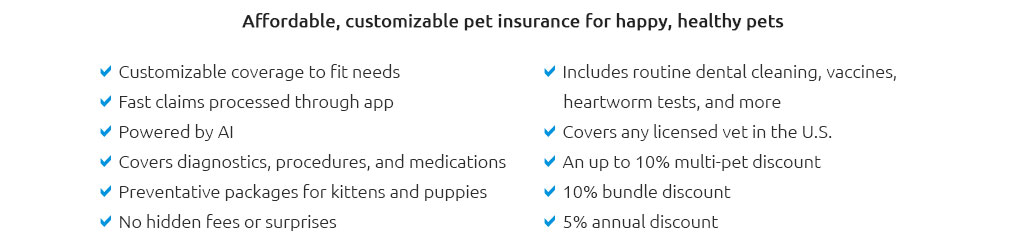

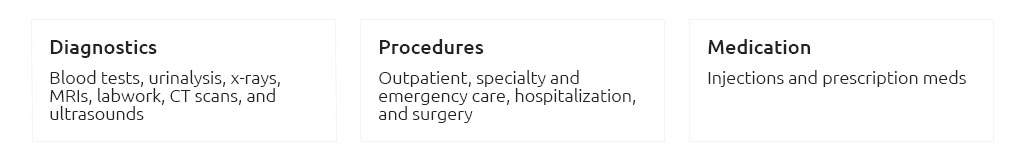

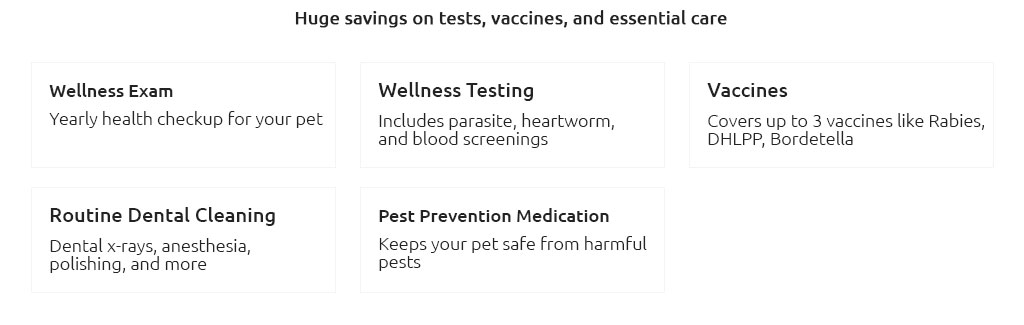

What wellness coverage usually includes

It's preventive. Not emergencies, not cancer treatments. It offsets predictable care and nudges consistency.

- Annual exams and rechecks

- Core vaccines (rabies, DHPP/FVRCP) and boosters

- Lab screens: fecal, heartworm, FeLV/FIV where applicable

- Deworming and microchip

- Flea/tick and heartworm prevention allowances

- Nail trims, anal gland expression, and sometimes a basic dental cleaning allowance

Common exclusions: accidents/illnesses, prescription diets, chronic meds, and anything pre-existing or outside the itemized schedule.

Proof of value: quick math

Realistic clinic pricing ranges help cut through marketing.

- Typical dog annual spend (low-to-mid US pricing): exam $65, rabies + DHPP $70, heartworm test $40, fecal $35, deworm $15, microchip $45 (if needed), preventives $180 - $240/year. Total used: $405 - $510 without microchip; $450 - $555 with it.

- Typical cat annual spend: exam $65, rabies + FVRCP $60, fecal $35, deworm $15, FeLV/FIV test $40 (as needed), preventives $120 - $200. Total used: $290 - $415.

Scenario A (dog): wellness add-on $28/month = $336/year. Annual reimbursement caps allow ~$420. Use the standard items and one nail trim, and you're roughly $60 - $100 ahead. Skip two items and you're behind.

Scenario B (cat): $20/month = $240/year with ~$300 cap. Use exam, core vaccines, fecal, and a few months of preventives and you clear ~$40 - $80 in net value.

It's a budget tool with cash back when you actually do the care. Reframed: you're prepaying for preventive services and receiving a structured rebate when you submit receipts.

Timing that lowers out-of-pocket

- Enroll a few weeks before your annual visit or adoption-day checklist. Many wellness riders have little or no waiting period, but annual maximums reset; you want your high-value items to land after activation.

- Avoid renewal gaps. If your vaccines hit in March and your plan resets in April, you just financed care with no reimbursement.

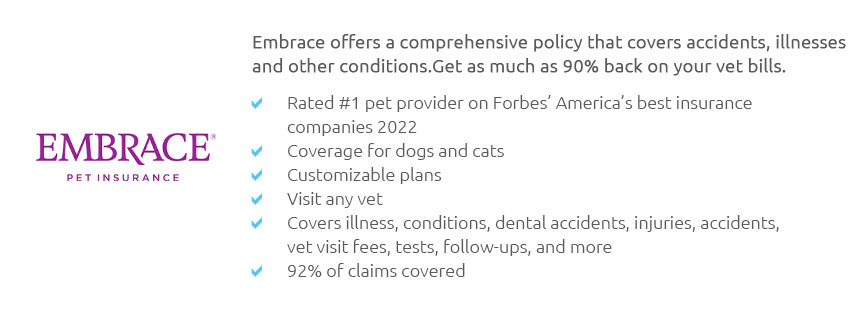

How to compare without a spreadsheet

- List your clinic's prices for exam, core shots, fecal, HW test, and 12 months of preventives.

- Match each item to the plan's per-item caps; ignore line items you won't use.

- Check payout style: fixed schedule vs flexible allowance. Schedule = predictability; allowance = wiggle room.

- Confirm exam fee inclusion and whether dental cleanings get any allowance.

- Look for easy claims (photo upload, weekend processing) and realistic payout times.

- Verify you can use any licensed vet and that routine meds count toward wellness.

A quiet real-world moment

Last April, after a Saturday vaccine clinic, I snapped a photo of Luna's invoice in the parking lot. Exam, DHPP, rabies, and fecal - submitted in two minutes. The reimbursement - $128 - posted by Wednesday. It didn't feel like a windfall; it felt like the plan did exactly what the schedule promised.

Red flags that sink value

- Annual wellness max below $250 for dogs or $200 for cats

- Exam fees excluded or capped at $20

- Prevention allowance too small to cover even half your brand's cost

- Waiting periods that push your appointment outside the coverage window

Who shouldn't bother

- You already buy a clinic wellness package that nets cheaper after in-house discounts.

- You never skip preventive care and your cash-back/credit rewards outpace plan overage.

- Your pet is geriatric and the plan's schedule emphasizes puppy/kitten items you won't use.

Who gets the most from it

- Puppies and kittens (vaccine-heavy months, microchip, early deworming)

- Households with multiple pets where adherence improves when costs are predictable

- Owners who value guardrails: fixed premium, scheduled reimbursements, fewer surprises

Final call: act if these three boxes check

- Your expected routine bill this policy year exceeds the annual premium by at least 20%.

- The plan's per-item caps meet or beat your clinic's actual prices on the services you'll use.

- Claims are simple enough that you'll submit the same day you pay.

If those line up, affordable wellness pet insurance isn't a maybe - it's timely. If not, set a sinking fund and revisit at your next vaccine cycle. Same goal, different tool.